Xiaomi Accused of Illegally Remitting Money Out of India

India recently investigated the Chinese smartphone giant Xiaomi and its affiliates for illegally remitting money out of India. This resulted in the seizure of assets by the Indian Department of Revenue Intelligence. The agency alleges that Xiaomi was not remitting money through the prescribed channels, which is illegal and undermines the integrity of the Indian foreign exchange system. The investigation is important in ensuring that all companies follow the same rules and regulations, particularly foreign ones. So let’s take a closer look at this case.

Background of Xiaomi

Xiaomi is a Chinese multinational electronics company founded by Lei Jun in 2010 and is headquartered in Beijing, China. It designs, develops, and sells smartphones, mobile apps, laptops, and related consumer electronics. As of August 2020, Xiaomi was the fourth-largest smartphone maker in the world after Apple, Samsung and Huawei. Over the past few years Xiaomi has expanded its business to India by opening its first retail store in New Delhi in July 2019. Furthermore, Xiaomi has partnered with many leading Indian companies such as Paytm Mall and Airtel to become one of India’s biggest technology investors.

Recently there have been allegations against Xiaomi for alleged transfer of funds which are illegal under Indian law regulations. The accusations follow reports that the Chinese tech giant illegally transferred $200 million out of India over 2017 and 2018 according to an investigation by the Central Bureau of Investigation based on documents available with various Ministry of Corporate Affairs (MCA) entities. The allegations have questioned whether or not the company had violated Foreign Exchange Management Act (FEMA) guidelines which require all foreign companies investing in India to comply with certain rules and regulations administered by RBI.

India Seizes Xiaomi Assets Over Illegal Remittances

Recently, allegations have arisen that the Chinese phone maker Xiaomi is illegally remitting money out of India. As a result, the Indian government has seized assets worth Rs.19,000 crore belonging to Xiaomi India, alleging that the company had violated laws by transferring funds outside the country without appropriate permission. This article will explore the allegations against Xiaomi and the context of the case.

Overview of Allegations

Xiaomi has recently come under fire following allegations that it has illegally sent money out of India to avoid paying taxes. The allegations further suggest that Xiaomi’s Indian subsidiary, Mi India Private Limited, has been remitting money out of India without authorization from the Reserve Bank of India (RBI). Additionally, it is alleged that Xiaomi’s Indian operations have “deployed funds for certain activities which contravened the RBI guidelines on foreign exchange transactions”.

The scandal first came to light when Indian authorities seized documents from Xiaomi during their investigation into an unrelated tax evasion complaint. The Mumbai Central Income Tax Appellate Tribunal (ITAT) revealed that these documents contained details about the illegal transfer of funds outside India. According to the ITAT, Xiaomi had carried out several transfers since 2016, ranging between US$1.99 million and US$15 million each. The Tribunal also mentioned that some of these transfers were related to acquisition and investments in overseas entities and funding a parent company in China.

The RBI and Central Board of Direct Taxes are continuing their investigation into Xiaomi’s alleged illegal remittances and searching for evidence of any violations they may have committed. As this case progresses, it could lead to significant repercussions for both Xiaomi and the tech industry in India depending on how it is resolved.

Evidence of Illegal Remittances

It has been alleged that Xiaomi and its associated companies, namely Mi Singapore and Mi Malaysia, violate Indian foreign exchange and payment laws. In addition, an independent agency report has revealed evidence suggesting that Xiaomi is involved in routing user payments from India to their affiliates abroad via its network of companies operating outside the country.

The report found multiple irregularities on Xiaomi’s part, including failure to submit documents or records related to overseas remittances, non-compliance with the requirement for a Foreign Currency Remittance Form (FCRF), lack of adequate internal controls to prevent and detect clandestine transfers of funds abroad, inadequate essential documents such as special audit reports, unbalanced between physical and virtual transfers through different banks accounts outside India. Additionally, bank accounts in various overseas locations were activated without obtaining prior approval from the Reserve Bank of India (RBI).

The allegations against Xiaomi have prompted further investigations from the regulator which is currently looking into potential financial misdeeds by the Chinese firm. The preliminary findings indicate that there have been significant discrepancies related to money remitted out of India and as a result, taxes may be due on those remittances.

Investigation

The Indian authorities have launched an investigation into Xiaomi after accusing the company of illegally remitting more than $500 million from India without the appropriate approvals. The Indian government has seized Xiaomi’s assets as part of the investigation, and the company is now facing potential criminal charges. Let’s look at the investigation’s details and what it could mean for the tech giant.

Indian Government’s Investigation

The Indian government is investigating Chinese electronics giant Xiaomi for violating central bank regulations by allegedly transferring large sums of money from India. Reports state that the income Xiaomi receives from selling smartphones in India is routed through holding companies in EU countries, leading to a violation of Foreign Exchange Management Act (FEMA) rules.

Over the past few months, India’s Enforcement Directorate has collected evidence from several Xiaomi offices during raids and questioned multiple top officials from the company. The investigation has concluded that more than US$1 billion had been illegally transferred out of India. These funds have reportedly been used to buy technology patents, expand into international markets and carry out other activities without authorization from authorities.

In response to these allegations, Xiaomi has stated that its global operations comply with local laws and regulations. The company also maintains that it has never remitted any funds outside India violating FEMA rules. However, it admits to having sent small quantities of money abroad for legal services and advertisements, which it insists was done with appropriate approval from regulators.

Many questions remain unanswered as investigators look into this alleged illegal remittance case involving Xiaomi. For example, it remains unclear how much money was involved or what impact this will have on Xiaomi and its users across the globe.

Impact on Xiaomi’s Operations in India

Investigation into Xiaomi’s activities by the Enforcement Directorate, a regulatory agency in India, has caused concern about the company’s operations. The ED has accused Xiaomi of illegally remitting money out of India without routeing it through their parent company in China. As a consequence, Xiaomi has had to suspend some services in India.

The investigation could cause significant problems for Xiaomi’s business as it might damage their credibility among Indian customers. Moreover, if any violations are found against Xiaomi, the government could impose heavy fines or sanctions on the tech giant. This could lead to operational disruptions or even halt operations if violations are too severe.

Furthermore, customers may reconsider buying Xiaomi devices due to data privacy and security concerns. This can have serious implications for profitability and growth prospects in India and could affect short- and long-term plans for expansion in the country.

The repercussions of such disputes can also have wider implications on India-China relations as Chinese tech giants have become increasingly dominant participants in the Indian economy over recent decades.

Response

The recent news involving Xiaomi being accused of illegally remitting money out of India has sparked a range of responses from members of the public, government entities and legal experts. This article will look at the reactions of all these parties to better understand the gravity of the situation and its potential repercussions.

Xiaomi’s Response to The Allegations

Xiaomi has issued a strong denial of any wrongdoing about the allegations. In a statement released Thursday, the company said it strictly complies with applicable laws and regulations in all markets it operates in, including India.

Xiaomi further clarified that it entered into multiple contracts with an Indian-based firm between 2018 and 2020 to pay for software development services, subject to Indian taxation laws. The contracts were conducted through normal banking channels and Xiaomi stated that it received appropriate approvals from the relevant Indian authorities before remitting the payments.

In addition, Xiaomi said that these payments have had no impact on their operations in India. Nevertheless, the company will cooperate fully with any investigation conducted by authorities regarding this matter.

Impact on Xiaomi’s reputation

The news of Xiaomi’s illegal money remittance out of India has caused a stir in the media landscape and raised concerns among many customers. This is especially true as the case against Xiaomi has caught public attention and reached the Supreme Court, leading to questions about the company’s practices.

As market leader in India, Xiaomi had built its reputation and trust among consumers by providing quality products at reasonable prices. However, this incident reduces consumer faith in their brand, as it questions whether or not Chinese firms can be trusted with customers’ money. This can have a long-term effect on their reputation in the Indian market regarding their products and services.

Moreover, this incident could also have consequences for other Chinese companies operating in India, leading to more scrutiny from customers and regulatory agencies regarding financial transactions. The case against Xiaomi thus serves as a cautionary tale for all players operating in the market, highlighting the importance of following established regulations when engaging in any business activities involving remitting funds out of the country.

Conclusion

After an extensive investigation by the Indian government, Xiaomi India was found to have made illegal remittances out of India in violation of forex regulations.

As a result, the Indian government has seized Xiaomi’s assets in the country. This case highlights the importance of complying with foreign exchange regulations in India. In this article, we discussed the legal issues arising from this case, the potential impacts, and the steps Xiaomi should take to move forward from this.

Summary of Findings

The research on Xiaomi’s alleged illegal remittance of funds from India has provided evidence of discrepancies in the company’s figures and those reported by foreign trade authorities. Unaccounted foreign exchange dealings aside, it is also suspected that Xiaomi may have violated Indian laws on several counts such as corporate tax avoidance, misdeclaration of cross border investments, and underreporting of profits.

In conclusion, there is substantial evidence to suggest that Xiaomi has been involved in illegal remittance of funds out of India. Additional detail and investigation into the matter may be necessary to take appropriate legal action against the company. Nevertheless, should these allegations prove correct, it would demonstrate significant corporate irresponsibility and neglect towards Indian laws.

Implications for Other Companies Operating in India

Xiaomi’s suspected illegal remittance of money out of India has implications for other companies operating in the country. Indian government regulations mandate that all companies in the country register with Indian Customs and the Reserve Bank of India (RBI). In addition, these entities must also comply with RBI’s Foreign Exchange Management Act, which controls and monitors incoming and outgoing payments made by foreign companies, among other measures. The penalties for non-compliance can be severe, up to a fine of 1 crore, jail time or both.

Therefore all international companies must ensure that they are following India’s regulations on remitting money from their operations in the country, or face significant sanctions. Moreover, the case highlights the importance for businesses entering unfamiliar markets to understand the intricacies of local laws before commencing operations. Global companies should seek specialised legal advice beforehand; failure to do so could result in substantial fines or even shut down operations completely if regulators impose firmer sanctions.

tags = xiaomi consumer electrics company, xiaomi smartphones, india vs xiaomi, illegal remittances, xiaomi under investigation, financial crime fighting agency, indian enforcement directorate 725m xiaomikalrareuters, sources enforcement directorate 725m xiaomikalrareuters, sources indian enforcement directorate xiaomikalrareuters, sources enforcement directorate xiaomikalrareuters, enforcement directorate 725m xiaomikalrareuters, xiaomi royalty payments, illegal act agains india, india’s leading smartphone seller, xiaomi chinese company

Everything You Need to Know About Car Transport for a Big Move

Everything You Need to Know About Car Transport for a Big Move  Why DUI Accidents Demand The Expertise Of A Lawyer

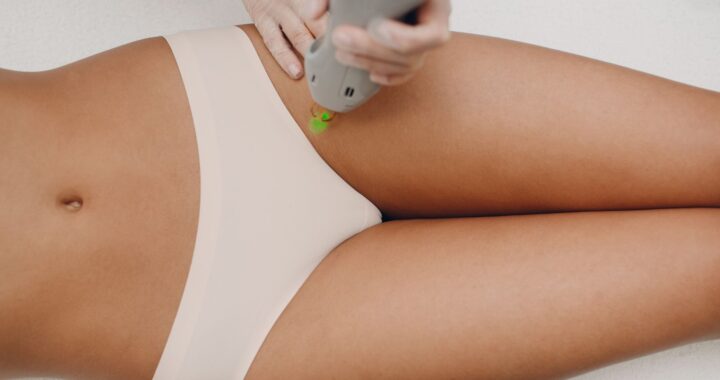

Why DUI Accidents Demand The Expertise Of A Lawyer  Bikini Underwear: Finding the Perfect Fit for All-Day Comfort

Bikini Underwear: Finding the Perfect Fit for All-Day Comfort  How to Satisfy Your Taco Cravings in Minutes by Ordering Tacos Online

How to Satisfy Your Taco Cravings in Minutes by Ordering Tacos Online  What A Pedestrian Accident Lawyer In Rochester Can Do To Protect Your Rights

What A Pedestrian Accident Lawyer In Rochester Can Do To Protect Your Rights  Pregnancy and Addiction: The Dual Struggle

Pregnancy and Addiction: The Dual Struggle