Why Would You Pick A Medicare Advantage Plan

Picking a Medicare Advantage plan can be confusing. Since there are so many choices, deciding which is ideal for you might be challenging. To assist you in choosing correctly, we will outline the advantages and disadvantages of choosing a Medicare Advantage plan in this article. Remember that these are only general guidelines. You should always consult your health insurance provider to find the right plan.

What are the benefits of a Medicare Advantage plan over traditional Medicare coverage?

The most important advantage of a Medicare Advantage plan is that it can help you lower your medical expenses. These plans are required to offer all the same coverage as Medicare Part A and Part B. Still, many also offer additional benefits, like prescription drug coverage or routine vision and dental care. In addition, Medicare Advantage plans typically have lower out-of-pocket costs than traditional Medicare, which can help you save money if you need to use your insurance frequently.

Another benefit of Medicare Advantage plans is that they often come with a smaller network of doctors and hospitals than traditional Medicare. It may be advantageous if you are in a region with few healthcare options because it will allow you to obtain the care you require without traveling far. In addition, smaller networks can often mean shorter wait times for appointments and procedures.

What are the drawbacks of a Medicare Advantage plan?

One of the most significant drawbacks of Medicare Advantage plans is that they can be more expensive than traditional Medicare. While these plans typically have lower out-of-pocket costs, the monthly premiums can be higher. In addition, some Medicare Advantage plans may require you to use specific doctors and hospitals within their network, limiting your choices if you need to see a specialist or receive care from a provider outside the network.

Another drawback of Medicare Advantage plans is that they often have less flexible coverage than traditional Medicare. Certain services, such as dental work or prescription medications, can require a higher out-of-pocket expense. In addition, some Medicare Advantage plans may not cover all of the same benefits as traditional Medicare, which could leave you with gaps in your coverage.

What are some things to consider when picking a Medicare Advantage plan?

It would help to consider a few things when picking a Medicare Advantage plan:

● Consider what type of coverage you need and how much you can afford to pay in premiums and out-of-pocket costs.

● Verify if the insurance plans you are thinking about cover your preferred doctors and hospitals.

● Read each plan’s fine print to ensure you understand what is covered and what is not.

Selecting a Medicare Advantage plan can be challenging. However, if you take the time to research your options and understand your needs, always consult with your health insurance provider to ensure you get the coverage you need.

What should you look for when comparing Medicare Advantage plans?

When comparing Medicare Advantage plans, you should look at the premiums, deductibles, and out-of-pocket costs. It would be beneficial if you also took into account the doctor and hospital network and the prescription drug coverage. Take the time to read the details of each plan to determine what is and is not covered.

How can you enroll in a Medicare Advantage plan?

You can enroll in a Medicare Advantage plan during the annual open enrollment period. It is the time when you can sign up for or change your Medicare coverage. You can also enroll in a Medicare Advantage plan if you qualify for a particular enrollment period. It may be due to a change in your circumstances, like losing your job-based health insurance.

What are the expenses a Medicare Advantage plan entails?

The expenses of a Medicare Advantage plan may vary. Some plans may have monthly premiums, while others may not. Deductibles and out-of-pocket costs would help if you also considered the network of doctors and hospitals and the coverage for prescription drugs. Make sure to read the small print of each plan to see what is and is not covered.

Are there any restrictions associated with a Medicare Advantage plan?

There are some restrictions associated with Medicare Advantage plans. For example, you may have to see specific doctors and hospitals that are in-network for your plan to cover your healthcare costs. It can be limiting if you have a doctor you prefer to see that is not in your plan’s network.

Another restriction is that Medicare Advantage plans can only be used in the US. You must purchase separate travel insurance to cover your medical expenses if you intend to travel outside the country.

Conclusion

Picking a Medicare Advantage plan can be a difficult decision. There are many things to consider, such as premiums, deductibles, out-of-pocket costs, and coverage. It is essential to research and understand your needs before enrolling in a plan. You should also consult with your health insurance provider to get the coverage you need.

Hiking for Mental Health: The Healing Power of Trails

Hiking for Mental Health: The Healing Power of Trails  Diet vs. Lifestyle Change: Knowing the Difference

Diet vs. Lifestyle Change: Knowing the Difference  Sleep Like a Pro: 10 Tips Backed by Science for a Restful Night

Sleep Like a Pro: 10 Tips Backed by Science for a Restful Night  How 7Stax 7-OHMZ Tablets Support Mental Health: 7 Key Benefits

How 7Stax 7-OHMZ Tablets Support Mental Health: 7 Key Benefits  The Complications That Could Arise From Using Cytotec to Induce Labor

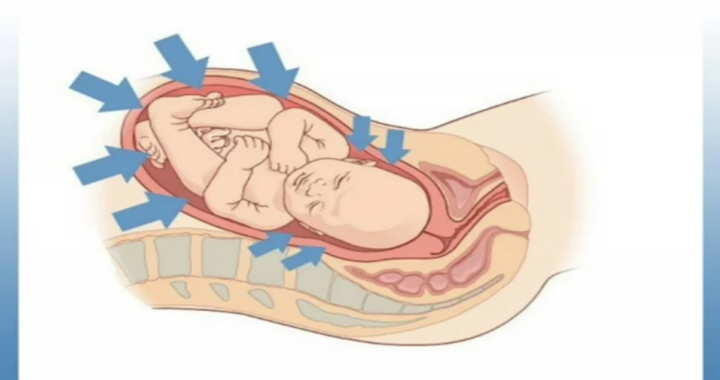

The Complications That Could Arise From Using Cytotec to Induce Labor  The Impact of Workplace Stress on Anxiety and Depression

The Impact of Workplace Stress on Anxiety and Depression