Stripe’s impressive growth trajectory

Investors certainly have good reasons to be impressed by Stripe’s spectacular growth trajectory, as it has become one of the world’s most valuable tech startups. Initially founded in 2010 by brothers John and Patrick Collison, Stripe is a payments company that processes millions of transactions daily and has incorporated its services into some of the world’s largest websites like Amazon, Lyft, Spotify, Twitter, and Uber Zoom. It also provides lending services for small businesses to provide them with the liquidity they need to stay afloat.

Recently announced in its Series H funding round led by Tiger Global Management and Allianz X, Stripe has now been valued at an incredible $115 billion – a figure that marks its second highest achievement in its 11-year history following a valuation of $36 billion two years prior. It is also worth more than double the amount estimated to be just one year ago at $35 billion. Notably, this places it right behind Airbnb as the world’s second most valuable venture-backed tech startup and fourth among all listed tech companies worldwide following Apple, Microsoft and Saudi Arabia’s Saudi Aramco. This demonstrates the rapid expansion experienced by Stripe over such a short timeline that shows no sign of slowing down anytime soon.

Growth Overview

The growth of Stripe has been impressive, with a valuation of $115 billion, the company has become the most valuable startup in the world. Stripe has become a beloved payment processor preferred by many businesses, and its success is driven by an expanding list of products, growing customer base, strategic investments, and valuable partnerships.

This article will provide a comprehensive overview of Stripe’s growth trajectory.

Revenue Growth

Since its inception in 2010, Stripe has become a major innovation force in the payment processing landscape. Fueled by its ability to quickly adapt to changing consumer needs, Stripe’s user base has grown exponentially over the last decade. In the second quarter of 2020 alone, the company processed $85 billion in payments, more than double that of the previous year. This impressive revenue growth has sent investors into a buying frenzy and pushed valuations to over $115 billion.

The strong growth trajectory at Stripe is primarily attributed to several key competitive advantages. Besides its intuitive user experience, merchants and developers appreciate how easy it is to sign up for Stripe’s services and integrate with ease-of-use shopping carts and third-party applications. Moreover, businesses are given greater control over how they get paid including wait times for settlement amounts and multiple ways for customers to pay including card payments, digital wallets such as Apple Pay, debit cards or even ACH transfers directly from bank accounts.

Stripe also understands that having superior services requires truly excellent customer service. To ensure sufficient customer success, it provides founders an impressive customer care center staffed by knowledgeable support personnel trained in web development best practices; it offers live chat support and phone support around the clock. The company also provides merchants access to dedicated account managers (AMS) who assist them throughout the onboarding journey and beyond – engaging actively on topics ranging from analytics insights operations improvement ideas and more.

These features have allowed Stripe to become a trusted payment partner for hundreds of thousands of businesses globally—a feat that few payment processors have achieved in such a short time. Investors certainly agree evidenced by their continued willingness to pour capital into this impressive financial technology powerhouse which continues scale steadily Upwards leaving us all wondering; will be able capitalize on this growth?

Expansion into New Markets

Since its founding in 2011, Stripe has grown rapidly, opening offices across the U.S. and expanding into new markets worldwide. Stripe currently operates in approximately 25 countries, where more than 36 million individuals and businesses use its suite of services to accept payments and manage their finances online.

In addition to expanding geographically, Stripe has been investing heavily in building its product capabilities to better serve customers. In recent years, it has launched products such as Stripe Connect, a comprehensive payment solutions suite for marketplaces and e-commerce providers; Atlas, an easier way for entrepreneurs based outside the US to form and manage a business; Terminal for physical card handling; and Radar for fraud prevention services. Earlier this year, Stripe announced the acquisition of TaxJar, an automated sales tax solution provider that helps merchants comply with complicated sales tax regulations worldwide.

Through these investments and acquisitions it appears clear that Stripe intends to remain at the forefront of technology advancement and customer service as it continues its impressive growth trajectory.

Growing Customer Base

Since its launch in 2011, Stripe has experienced tremendous growth in its customer base. Over the past decade, the company has expanded its services to include large companies and international customers in more than 40 countries. This has been driven by increased demand for digital payment and financial services and a rising acceptance of mobile payment applications. Stripe also offers all customers a wide range of products and services to meet their changing needs.

The company’s success can be attributed to numerous factors, including its ability to attract high-level talent and innovators and deploying world-class technology that drives user engagement and makes transactions seamless for both customers and businesses. Stripe’s relentless focus on product excellence attracted blockbuster investments from firms such as Andreessen Horowitz, General Catalyst Partners, Sequoia Capital, Kleiner Perkins Caufield & Byers (KPCB), Valiant Capital Partners and Thrive Capital. In addition, this focus on product innovation has led to significant strategic partnerships with global technology companies such as Apple’s iTunes Connect and Facebook’s Developer Platforms.

In addition to Stripe’s impressive growth trajectory which includes reaching $995 million in yearly recurring revenue earlier this year alone – investors are now valuing the company at $115 billion – indicating an almost eighteenfold increase since the company was founded just over 10 years ago. The future remains bright for Stripe as the digital payments market continues to grow exponentially – with new innovative products already launching that companies like PayPal & Zelle cannot match.

Investors Are Now Valuing Stripe At $115 Billion

Stripe’s investment portfolio has grown exponentially quickly, allowing them to now be valued at a staggering $115 billion. Investors are seeing the potential in Stripe and taking advantage of it.

This section will explore the reasons for Stripe’s impressive growth trajectory and its potential opportunities for investors.

Number of Investors

Investors are now valuing Stripe at an impressive $115 billion. As a result, there has been an immense amount of enthusiasm toward the Stripe brand, with a staggering number of investors taking part in the round of funding. According to Crunchbase, Stripe’s latest funding round consists of 23 investors, including three venture firms and other noteworthy investment companies, such as Fidelity Management & Research Company LLC and AXA Venture Partners. Moreover, additional investments have been made by VI Ventures LLC, Kiva Foundation, Vulcan Capital and several others.

The wide range of investors indicates many people’s confidence in this growing digital-payments powerhouse. As technology becomes increasingly more prevalent in our day-to-day lives, innovative businesses such as Stripe offer efficient and cost-effective ways for organizations and customers alike to streamline various functions in their lives that were once laborious handlings that took significant amounts of time to complete manually. With increasing levels of trust and success from the company’s current projects, it’s no surprise that so many investors are actively pursuing involvement in this venture.

Valuation of Stripe

Stripe, the payments company, has seen its valuation skyrocket over the past few years and it’s now been valued at $115 billion. How did Stripe become so valuable?

At its core, Stripe’s business model and technology enable businesses to accept payments online easily and quickly. While there are many payment processing companies on the market, Stripe stands out for various reasons investors appreciate.

First, Stripe has an expansive suite of products and services beyond just payment processing. Fintech offerings such as capital financing options for small businesses have been a huge draw for investors looking to dive into digital banking. With world-class software developers and engineers, they are building their banking infrastructure for existing customers through partnerships with financial institutions including Goldman Sachs and Barclays.

Second, Stripe has consistently reinvested any profits into innovation-driven initiatives such as AI powered commerce bots and blockchain technology implementation. These initiatives have allowed them to remain one of the most innovative technology companies in an ever-changing industry. They also ensure that this innovation is mission-focused to ensure customer satisfaction remains high throughout their growth cycle which bodes well for future investments.

In addition to these points of value, Stripe continues acqui-hire top talent which increases investor confidence in terms of product scalability while reducing long term risk by keeping large shareholders on board instead of diluting shareholding equity further down the line. There’s also massive potential in terms of global expansion opportunities as they look to expand beyond just US borders into Asia and Europe in 2021 – projections that investors find very exciting indeed.

It’s perhaps not surprising then that investors have taken notice of Stripe’s impressive growth trajectory throughout 2020 sending shares soaring higher than ever before, valuing them at $115 billion!

Future of Stripe

Stripe’s impressive growth trajectory has made it one of the most valuable startups ever, with investors valuing the company at an estimated $115 billion.

Stripe is taking on traditional payment companies and emerging technologies with its innovative payment solutions.

This article will discuss where Stripe might go in the future, and how it plans to stay ahead of the competition.

Plans for Expansion

Stripe has grown exponentially since its formation in 2010, and investors are now valuing the company at an impressive $115 billion. This makes it the most valuable private tech firm in the U.S. with a market cap comparable to that of PayPal and more than double that of Airbnb. Stripe’s impressive growth trajectory is partly due to its rapid expansion into new areas, such as providing infrastructure to run online businesses and powering payments for Apple, Amazon, Twitter, and many other big-name brands worldwide.

As Stripe continues to build upon its success, it continually seeks ways to innovate and expand their service offering. In February 2021, Stripe announced plans to launch their first European office in London. The new office will focus on customer support and product development for European markets, helping hundreds of thousands of businesses from across Europe access Stripe’s signature payment processing services.

In addition, Stripe strongly believes that investing in local markets wherever possible is essential for long-term growth for any international company and is actively exploring opportunities to launch offices in other regions including Asia Pacific and Latin America.

Acquisitions

Since its founding in 2011, Stripe has attracted significant venture capital (VC) investments and has grown strategically through several acquisitions. In February 2021 the company announced one of the largest funding rounds in history, propelling the global payments platform to a $115 billion valuation. Additionally, stripe has acquired over 20 companies in the past 6 years, including two of their largest acquisitions, Touchtech Payments and Paystack, for approximately $200 million in 2019 and 2020 respectively.

Other acquisitions include ShoCard, an enterprise authentication platform; KickoffLabs a growth hacking platform; Indiez a freelance engineering talent marketplace; Pay with Privacy for data privacy management; Index for virtual cards; PacStorage for omnichannel payment processing; Stellar’s distributed ledger network as an e-commerce toolkit designed to help merchants reduce fraud and losses from chargebacks.

In addition to their growing list of strategic buys, Stripe also extended its capabilities by introducing products like Stripe Issuing which enables businesses to issue virtual and physical cards enabled by Mastercard or Visa networks while allowing a degree of customization to tailor prepaid cards according to their business use-cases. By leveraging these various asset acquisitions, they position themselves as an innovative enterprise financial technology solutions leader.

Conclusion

Stripe’s impressive growth trajectory is an inspiring example of how a creative and innovative approach to business can yield immense success. From its humble beginnings, Stripe has developed into the world’s most valuable (and most beloved) payment processor, with an ever-expanding roster of customers and partners across the globe.

Investors believe in Stripe’s long-term potential, as evidenced by their monumental valuation of $115 billion. However, while Stripe has certainly come a long way, the company still has more milestones ahead as it continues to revolutionize global payments technology and expand its presence worldwide.

How to Maximize Your Rehab Insurance Benefits

How to Maximize Your Rehab Insurance Benefits  Everything You Need to Know About Car Transport for a Big Move

Everything You Need to Know About Car Transport for a Big Move  Why DUI Accidents Demand The Expertise Of A Lawyer

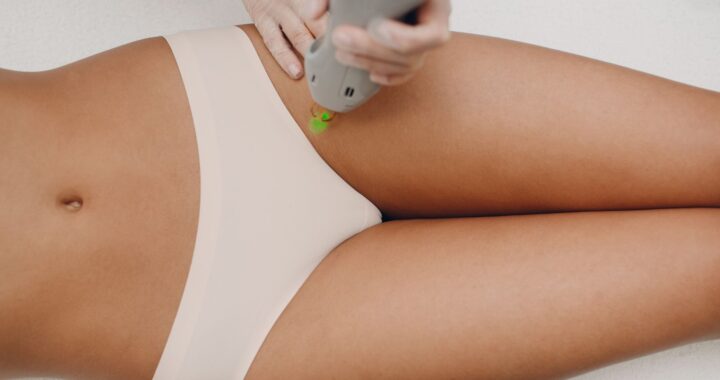

Why DUI Accidents Demand The Expertise Of A Lawyer  Bikini Underwear: Finding the Perfect Fit for All-Day Comfort

Bikini Underwear: Finding the Perfect Fit for All-Day Comfort  How to Satisfy Your Taco Cravings in Minutes by Ordering Tacos Online

How to Satisfy Your Taco Cravings in Minutes by Ordering Tacos Online  Finding a Luxury Resort in Belize

Finding a Luxury Resort in Belize