How And Why To Use A Life Insurance Calculator

One convenient aspect of the rise of modern technology is how easy it is to research our potential purchases and required services before we part with any money. Purchasing any kind of insurance requires due diligence and research, but this is especially true of life insurance. Using a life insurance calculator gives us a much clearer picture of the coverage we need in preparation for comparing quotes.

What does a Life Insurance Calculator do?

A life insurance calculator takes the information you give it and recommends the amount of coverage to protect your loved ones and other dependents in the case of your untimely death. When using a life insurance calculator, you will typically need to provide the following information:

- Annual income—When calculating how much cover you will need for your dependents to maintain their current standard of living, your current annual income is critical.

- Savings and investments—Any savings or assets available to your dependents in your absence should be inputted.

- Length of payments—For an accurate calculation, you must decide how long you want your dependents to receive payments.

- Existing debts and fiscal responsibilities—You should declare any loans like mortgages, vehicle loans, and any other financial liabilities that your dependents may be responsible for.

- Predicted future costs—If you expect to incur any significant future costs, they should be noted here.

- Existing life insurance policies—If you have existing coverage, your new policy can forego certain aspects; the system will assess this and adjust its recommendations accordingly.

- Estimated final expenses—Some calculators may ask you to estimate your funeral and burial expenses.

How do I Make the Ideal Use of a Life Insurance Calculator?

A life insurance calculator should be viewed as a financial tool that provides information and insight during your research process. Before using comparison sites to compare life insurance quotes, it pays to have as much information as possible.

The more accurately you can define your needs, the more closely the provided quotes will match your needs. A life insurance calculator is an excellent resource for honing your requirements.

The Benefits of a Life Insurance Calculator when Researching Quotes

For the most transparent view of our financial needs and the perfect amount of coverage competing policies should provide; a life insurance calculator is an invaluable tool.

Obtaining sufficient information is crucial when making significant financial purchases. It is easy to acquire a raft of life insurance quotes quickly, but they are of little use if they do not accurately represent our needs. A life insurance calculator clarifies the situation and allows us to procure quotes that address our requirements more closely. Once you have gathered all the necessary information, they are fast and easy to use, and the system will guide you through the process step by step.

A life insurance calculator is an excellent way to garner information and insight when embarking on a journey to source the ideal life insurance. However, it is not a replacement for other elements of your research, and you will still need to contact potential providers directly.

Everything You Need to Know About Car Transport for a Big Move

Everything You Need to Know About Car Transport for a Big Move  Why DUI Accidents Demand The Expertise Of A Lawyer

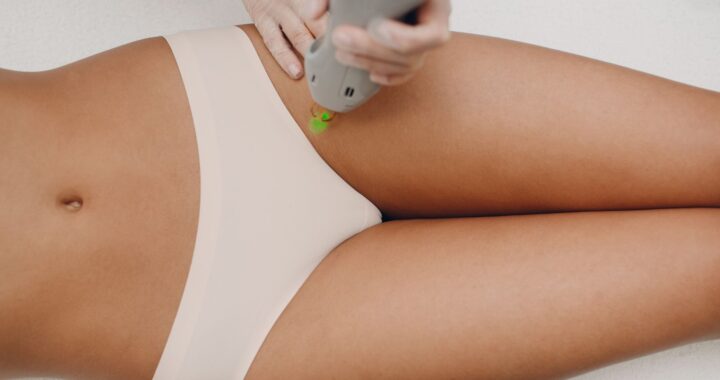

Why DUI Accidents Demand The Expertise Of A Lawyer  Bikini Underwear: Finding the Perfect Fit for All-Day Comfort

Bikini Underwear: Finding the Perfect Fit for All-Day Comfort  How to Satisfy Your Taco Cravings in Minutes by Ordering Tacos Online

How to Satisfy Your Taco Cravings in Minutes by Ordering Tacos Online  Finding a Luxury Resort in Belize

Finding a Luxury Resort in Belize  How to Create Lasting Wellness by Supporting Those Around You

How to Create Lasting Wellness by Supporting Those Around You